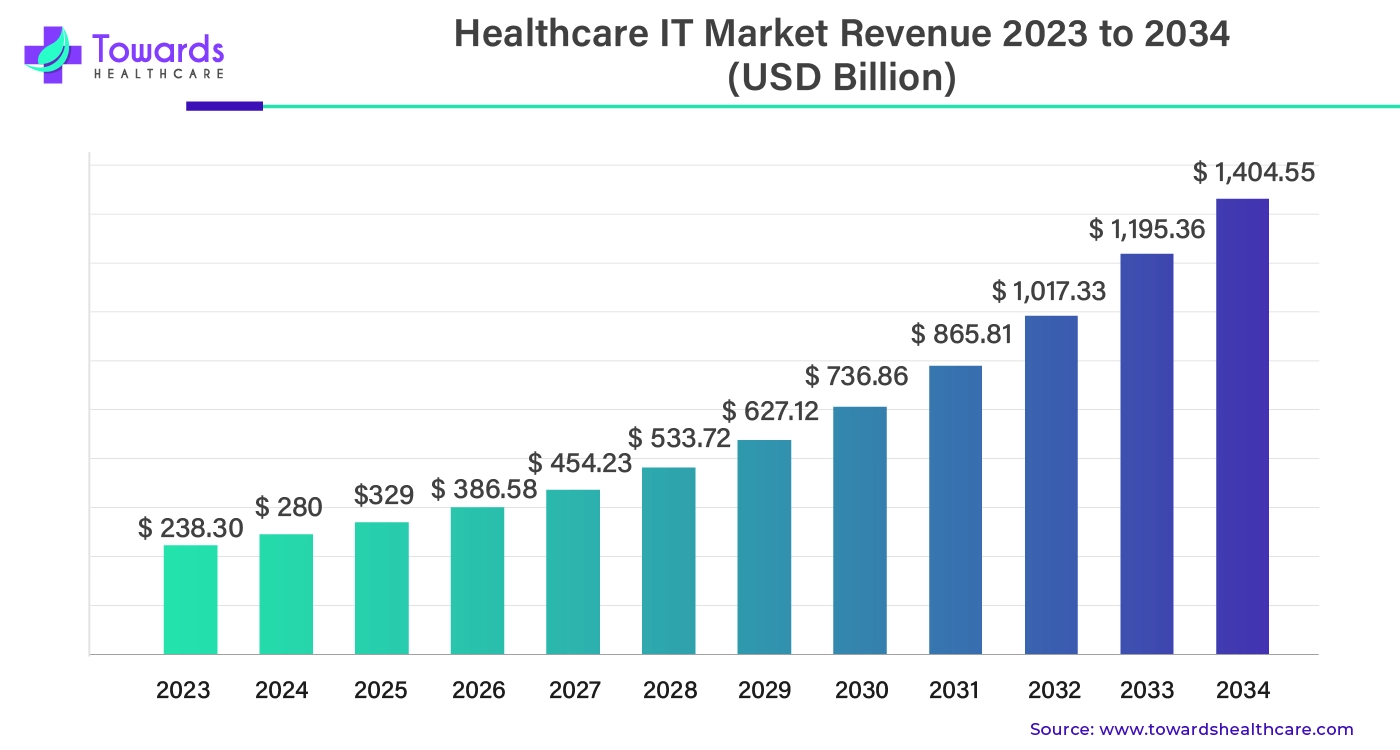

Healthcare IT Market Size Expected to Reach USD 1,404.55 Bn by 2034

Ottawa, Nov. 14, 2024 (GLOBE NEWSWIRE) -- The global healthcare IT market size is predicted to increase from USD 329 billion in 2025 to approximately USD 1,195.36 billion by 2033, according to a study published by Towards Healthcare a sister firm of Precedence Statistics. North America led the healthcare IT market with the largest market share of 41% in 2023. Asia Pacific is expected to grow at the fastest CAGR during the forecast period.

Download statistics of this report @ https://www.towardshealthcare.com/download-statistics/5220

In healthcare, the growing application of big data and analytics covers real-time patient monitoring, and predictive diagnosis, these technologies raise decision-making accuracy and operational efficiency, which reduces costs and yields better results. To modernize healthcare and make it more efficient, data-centric, and patient-focused, the market is crucial. This market is expected to grow steadily and influence the direction of healthcare worldwide with sustained investment and technical advancement.

- The World Health Organization estimates that chronic diseases cause 74% of all deaths worldwide.

- Since chronic diseases necessitate continuous care and treatment, they significantly contribute to the rising demand for mHealth app services. People who suffer from chronic illnesses can use mHealth apps to monitor their health, track their progress, and prevent complications.

- For instance, mHealth apps can help people with diabetes monitor their diet, insulin dosage, and blood sugar levels. They might also send reminders for taking prescription drugs and exercising.

Get the latest insights on healthcare industry segmentation with our Annual Membership: https://www.towardshealthcare.com/get-an-annual-membership

Major Trends in Healthcare IT Market

- Data management in healthcare: The healthcare industry offers massive volumes of data, including genetic data, patient records, lab results, medical imaging data, and data from wearable technology. The effective data management has become vital as healthcare data is predicted to increase dramatically. AI and machine learning can examine large datasets, spot patterns, and produce insights beyond human capacity due to sophisticated data management systems.

- Adoption of 5G enables faster and more reliable data transmission: Data from remote monitoring devices, like wearable implanted sensors, and health trackers may be sent to healthcare providers quickly because of 5G's reduced latency. This makes it possible to continuously and instantly monitor patients' vital signs, enabling timely actions when needed.

- Advancements in cybersecurity are crucial for protecting sensitive patient information: Increased security measures are necessary due to new vulnerabilities brought about by the healthcare industry's transition to cloud computing and telemedicine. Because authorized people can access patient data in the cloud from multiple places, it is more susceptible to unwanted access.

Insights from Key Regions

North America’s Sustained Dominance in Healthcare IT Market

The factors propelling the growth of the healthcare IT market include rising awareness of digital health, government regulations and financial incentives for the adoption of HCIT solutions, the growing use of big data in healthcare management, the high return on IT investment in the healthcare sector, and the rise in the prevalence of chronic diseases. A recent poll found that 59% of people utilize the mHealth platform to keep an eye on their health. Likewise, 40% of those surveyed said they would be prepared to pay for this kind of service. More consumer-focused medical treatment is being demanded by patients.

- To help healthcare firms improve patient care, strengthen their supply chains, and boost financial visibility, Oracle is adding new healthcare-specific features to the Oracle Fusion Cloud Applications Suite. Thanks to the new capabilities, Healthcare firms will adopt new business models, boost decision-making, lower expenses, increase efficiency, and better meet patient requirements.

- IBM has teamed with governments, hospitals, and life sciences companies to improve patient outcomes, enhance administration, and streamline treatment. Its technology has enhanced the healthcare ecosystem, achieving the company's goal of performing good work for clients to do good for the world.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Asia- Pacific's Healthcare IT Industry

To meet the needs of the expanding population, governments in emerging nations are taking steps to establish brand-new, cutting-edge healthcare facilities. The demand for cutting-edge medical equipment and technology in the healthcare industry to enhance nursing staff workflow will expand in tandem with the expansion of healthcare facilities. Even nurse ID badges are being outfitted by hospitals with an RFID tag that connects to the hospital's Wi-Fi network. These tags monitor the nurses' movements during their shifts.

- With a focus on future innovation and tackling the triple purpose of care in complicated environments, TCS supports current research, services, and technology issues. It emphasizes how TCS's go-to-market capabilities have been enhanced by the integration of its partnership ecosystem, innovation, and linked capabilities, which are driven by knowledge addressing important industry concerns (clinical operations, patient experience, and compliance).

Healthcare IT Market Segmentation

- By type, the healthcare provider solutions segment held the largest share of the healthcare IT market in 2023. Telemedicine gives patients more flexibility and convenience while also assisting in expanding access to care for underserved or rural areas. As a result of healthcare providers investing in telemedicine platforms, the market share of provider solutions in the healthcare IT market is growing. Tools for patient involvement have been shown to enhance medication adherence and change in lifestyle, both of which have a direct positive impact on health outcomes.

- By end-use, the healthcare providers segment dominated the healthcare IT market in 2023. To help doctors make timely, evidence-based judgments and evaluate patient data more precisely, providers are using AI and machine learning more and more to enhance clinical decision-making. Provider demand is high due to CDS systems' integration with EHRs and other healthcare IT solutions.

GE HealthCare keeps producing cleverly effective radiological advances that help physicians with medical imaging. Advanced imaging technology and auxiliary systems that provide a collaborative care setting are examples of such advancements, which contribute to patients having access to medical imaging at the appropriate time and location.

Competitive Landscape & Major Breakthroughs in the Healthcare IT Market

The healthcare IT market continues to evolve rapidly, with 2023 witnessing significant advancements and a dynamic competitive landscape. Major players such as Accenture, IBM, GE Healthcare, eMDs, Inc., McKesson Corporation, and Novarad dominate the healthcare IT market.

Among the many uses of information technology (IT) in the healthcare sector are data management, treatment plan development, staff data management, accurate diagnosis, financial data management, heat management applications, conversational systems, electronic billing, resource management, equipment management, and many more.

What is Going Around the Globe?

- In November 2024, In order to promote innovation and the use of artificial intelligence (AI) in medical imaging, GE HealthCare and Deep Health, a RadNet subsidiary, established a strategic partnership.

- In October 2024, Consus.health, a top German healthcare management consultant, has been fully acquired by Accenture. It provides a wide range of services, including infrastructure, logistics, procurement, construction planning, medical strategy and patient management.

- In August 2024, McKesson, a provider of healthcare services, agreed in writing to pay roughly $2.49 billion to purchase a majority stake in Community Oncology Revitalization Enterprise Ventures (Core Ventures).

Browse More Insights of Towards Healthcare:

- The healthcare digital twin market was valued at USD 1.17 billion in 2022 and is projected to reach USD 38.43 billion by 2032, growing at a CAGR of 42.2%.

- The generative AI in healthcare market is estimated to grow from USD 1.07 billion in 2022 at a CAGR of 35.1% (2023-2032) to reach an estimated USD 21.74 billion by 2032.

- The artificial intelligence in drug discovery market size was estimated at USD 1,495.28 million in 2022 and is projected to hit around USD 14,518.68 million by 2032, registering growth at a CAGR of 20.08% from 2022 to 2032.

- The blockchain in healthcare market size reached USD 0.76 billion in 2022 and is projected to hit around USD 14.25 billion in 2032, expanding at a healthy CAGR of 34.02% from 2023 to 2032.

- The telehealth and telemedicine market reached USD 214.55 billion in 2023 and is projected to grow to USD 869.22 billion by 2033, expanding at a robust CAGR of 15.5% during the forecast period from 2023 to 2033.

- The electronic health records (EHRs) market reached USD 27.42 billion in 2023 and is expected to grow to USD 41.87 billion by 2033, with a projected CAGR of 4.32% from 2024 to 2033.

- The healthcare automation market was valued at USD 34.50 billion in 2022 and is projected to reach USD 80.28 billion by 2032, growing at a CAGR of 9.3%.

- The healthcare and medical simulation market was estimated at USD 2.14 billion in 2023 and is projected to grow to USD 7.04 billion by 2034, rising at a CAGR of 11.44% from 2024 to 2034.

- The robotic dentistry market was estimated at USD 535 million in 2023 and is projected to grow to USD 2,585.94 million by 2034, rising at a CAGR of 15.4% from 2024 to 2034.

- The smart ward market was estimated at USD 3.06 billion in 2023 and is projected to grow to USD 11.83 billion by 2034, rising at a CAGR of 13.1% from 2024 to 2034.

Segments Covered in the Report

By Type

- Healthcare Provider Solutions

- Clinical Solutions

- Electronic Health/Medical Records

- Vendor Neutral Archive (VNA)

- Computerized Physician Order Entry

- Clinical Decision Support Systems

- Radiology Information Systems

- Radiation Dose Management Solution

- Specialty Management Information Systems

- Medical Image Processing & Analysis Solution

- Healthcare IT Integration Systems

- Practice Management Systems

- Laboratory Information Systems

- Digital Pathology Solutions

- Mobile Health (mHealth) Solutions

- Telehealth Solutions

- Healthcare Payer Solutions

- Pharmacy Analysis and Audit

- Claims Management

- Fraud Management

- Computer-assisted Coding Systems

- Payment Management

- Patient Billing Management

- Provider Billing Management

- Provider Network Management

- Member Eligibility Management

- Customer Relationship Management

- Medical Document Management

- Other

- HCIT Outsourcing Services

- Provider HCIT Outsourcing Services

- Medical Document Management Services

- Pharmacy Information Management Services

- Laboratory Information Management Services

- Revenue Cycle Management Services

- Others

- Provider HCIT Outsourcing Services

- IT Infrastructure Management Services

- Operational HCIT Outsourcing Services

- Supply Chain Management Services

- Business Process Management Services

- Others

- Payer HCIT Outsourcing Services

- Claim Management

- Customer Relationship Management Services

- Billing System

- Fraud Detection

- Others

By End User

- Healthcare Providers

- Hospitals

- Ambulatory Care Centers

- Diagnostic & Imaging Centers

- Pharmacies

- Others

- Healthcare Payers

- Private Payers

- Public Payers

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Discover our detailed Table of Contents (TOC) for the Industry, providing a thorough examination of market segments, material, emerging technologies and key trends. Our TOC offers a structured analysis of market dynamics, emerging innovations, and regional dynamics to guide your strategic decisions in this rapidly evolving healthcare field - https://www.towardshealthcare.com/table-of-content/healthcare-it-market-sizing

Acquire our comprehensive analysis today @ https://www.towardshealthcare.com/price/5220

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Gain access to the latest insights and statistics in the healthcare industry by subscribing to our Annual Membership. Stay updated on healthcare industry segmentation with detailed reports, market trends, and expert analysis tailored to your needs. Stay ahead of the curve with valuable resources and strategic recommendations. Join today to unlock a wealth of knowledge and opportunities in the dynamic world of healthcare: Get a Subscription

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics to the healthcare sector, committed to forming creative connections that result in actionable insights and creative innovations. We are a global strategy consulting firm that assists business leaders in gaining a competitive edge and accelerating growth. We are a provider of technological solutions, clinical research services, and advanced analytics to the healthcare sector, committed to forming creative connections that result in actionable insights and creative innovations.

Browse our Brand-New Journals:

https://www.towardspackaging.com

https://www.towardsautomotive.com

https://www.precedenceresearch.com

For Latest Update Follow Us: https://www.linkedin.com/company/towards-healthcare

Get Our Freshly Printed Chronicle: https://www.healthcarewebwire.com

© Copyright Globe Newswire, Inc. All rights reserved. The information contained in this news report may not be published, broadcast or otherwise distributed without the prior written authority of Globe Newswire, Inc.